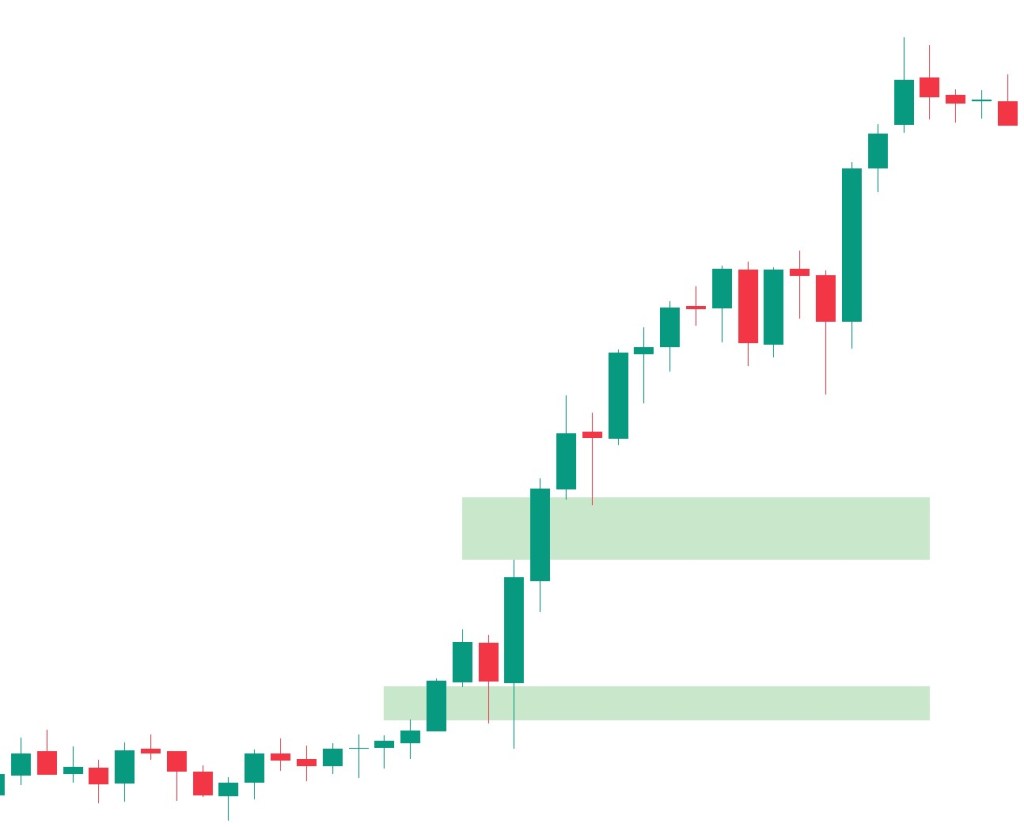

Fair Value Gaps (FVGs) have gained considerable attention among traders for their unique ability to find trading opportunities with precision. These gaps represent imbalances in price movement on a chart, often forming when a surge of institutional buying or selling causes prices to move rapidly, leaving an untraded zone behind. For beginners, understanding FVGs can be groundbreaking, offering insights that go beyond conventional trading tools. This article delves into why FVGs are superior and provides actionable advice on avoiding common mistakes when using them.

Why Fair Value Gaps Are Superior

One of the most significant advantages of FVGs is their precision in identifying actionable trading opportunities. Unlike many indicators that offer vague signals, FVGs highlight specific price levels where institutional activity is likely to have occurred. These zones often act as magnets, attracting price back to them for a test or a reversal. This clarity makes FVGs an invaluable tool for traders seeking well-defined entry and exit points.

Additionally to their precision, FVGs excel at filtering market noise and identifying trends. Beginners often struggle to differentiate genuine market trends from random price fluctuations. FVGs simplify this process by indicating areas of significant market interest. When price revisits an FVG, it often signals either a continuation of the current trend or a reversal, offering traders a high degree of confidence in their decisions.

Another key strength of FVGs is their adaptability across various market conditions and instruments. Whether you are trading stocks, forex, or cryptocurrencies, FVGs keep their relevance. They are equally effective across different timeframes, making them suitable for day traders, swing traders, and even long-term investors. This versatility ensures that traders can incorporate FVGs into almost any trading strategy.

FVGs also complement other trading tools, enhancing their reliability. For example, combining FVG analysis with moving averages or relative strength index (RSI) can improve signal accuracy. Similarly, traders who use order flow or market structure analysis will find that FVGs align well with these approaches, providing extra layers of confirmation.

Common Mistakes to Avoid When Using FVGs

Common Mistakes at a Glance:

- Misidentifying FVGs as random price gaps without validation.

- Overlooking broader market context and trading every FVG.

- Using FVGs in isolation without confirmation from other indicators.

- Overtrading by attempting to exploit every FVG regardless of quality.

- Applying FVGs on inappropriate timeframes for the trading strategy.

Despite their advantages, FVGs can lead to costly mistakes if not used correctly. One of the most common errors is misidentifying FVGs. Beginners often confuse FVGs with random price gaps, which may have no significant market implication. To avoid this, it is crucial to confirm the presence of an FVG within the context of the prevailing trend and volume levels. An FVG accompanied by a significant spike in trading volume or forming in line with market direction is more likely to yield profitable outcomes.

Another frequent mistake is overlooking the broader market context. Trading every FVG that appears on the chart without considering its alignment with the larger market structure can result in losses. For instance, attempting to trade an FVG in a strong downtrend without acknowledging the bearish momentum is a recipe for failure. Always analyze FVGs within the framework of support and resistance levels or supply and demand zones.

A third pitfall is using FVGs in isolation. While FVGs are powerful, relying solely on them without confirmation from other indicators or setups can lead to unreliable results. Effective trading requires a holistic approach, where FVGs act as one piece of the puzzle rather than the entire strategy.

Overtrading based on FVG signals is another common error among beginners. The temptation to trade every gap is understandable but unwise. Not all FVGs are created equal, and many may lack the characteristics of a high-probability setup. Focus on identifying well-formed FVGs in liquid markets, and remember that quality always trumps quantity in trading.

Finally, beginners often neglect to consider the appropriate timeframe when using FVGs. Applying FVG analysis on a timeframe that does not align with your trading strategy can lead to poor decision-making. For example, a day trader analyzing FVGs on a weekly chart may miss intraday opportunities, while a swing trader focusing on a five-minute chart could be overwhelmed by noise. Make sure that the timeframe of your analysis matches your trading objectives.

Best Practices for Effective FVG Use

To harness the full potential of FVGs, traders should adopt a structured approach. Start by integrating FVG analysis with market structure. An FVG that aligns with support or resistance zones is far more reliable than one appearing in isolation. Similarly, confirm the significance of an FVG by analyzing volume and trend direction. An FVG supported by a volume spike or consistent with the prevailing trend is more likely to lead to profitable trades.

Risk management is another critical aspect of trading with FVGs. Set logical stop-loss levels near the FVG zone to protect your capital from unexpected market movements. For instance, if you are entering a trade based on an FVG, place your stop-loss slightly above or below the gap, depending on the direction of your trade.

Focus on high-quality setups rather than trying to exploit every FVG. A well-formed FVG in a liquid market with clear alignment to broader market dynamics is a much better candidate for trading than a poorly defined one. Practicing patience and waiting for these optimal setups can significantly enhance your trading success.

Fair Value Gaps are a powerful tool for traders at all levels, but especially for beginners seeking clarity in a complex market environment. Their precision, adaptability, and compatibility with other tools make them superior to many conventional trading indicators. Yet, to use FVGs effectively, it is essential to avoid common pitfalls like misidentification, overtrading, and ignoring market context. By adhering to best practices and integrating FVG analysis into a comprehensive trading strategy, traders can unlock their potential and achieve consistent success.

Leave a comment